On 22 July, Indigo-Ltd released the full results of their 6-week audience survey, distributed by 258 UK cultural organisations and capturing over 103k responses.

In partnership with Indigo, Culture Counts ran statistical analysis on the big data captured to offer a breakdown of the key factors within the result. We hope this analysis will complement the overall analysis and other research happening in the sector. We recommend looking at the Indigo report available here and our initial factor analysis from May here.

The results that matter

All survey responses matter, however when using data to plan and make decisions the question is a statistical one – are these results representative of my entire audience? The factor analysis tells us how big the differences are in the results and where to find them.

This analysis tested 12 factors (see methodology) and found some unique and/or intuitive interactions:

- Regular attendees are more likely to attend a digital event, but are also more likely to have attended a digital event before lockdown.

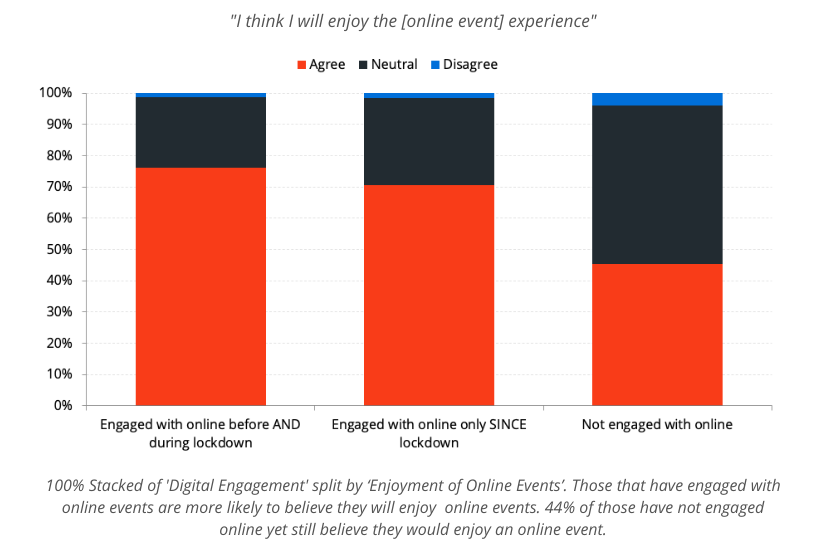

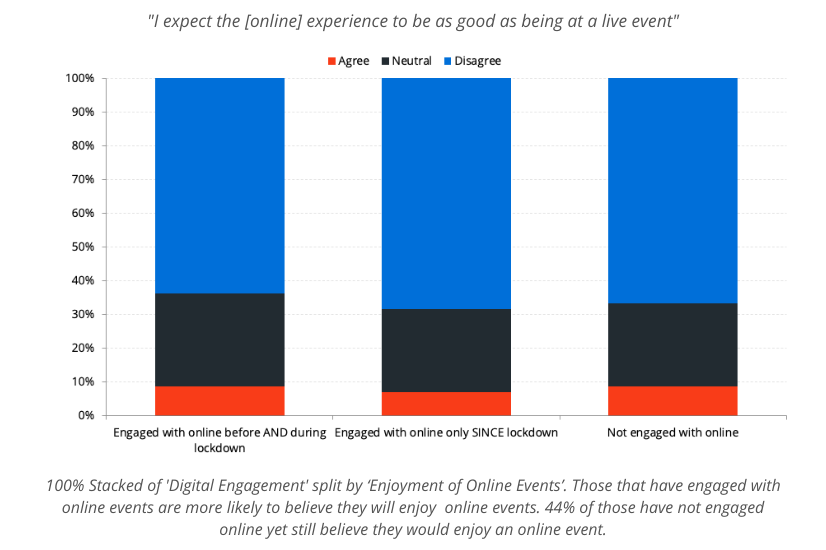

- Audiences do not expect digital events to replace live events, but they do expect to enjoy them. Those that have not attended a digital event are more likely to be neutral about their expectation they will enjoy online events. Few people (<5%) expect they will not enjoy a digital event.

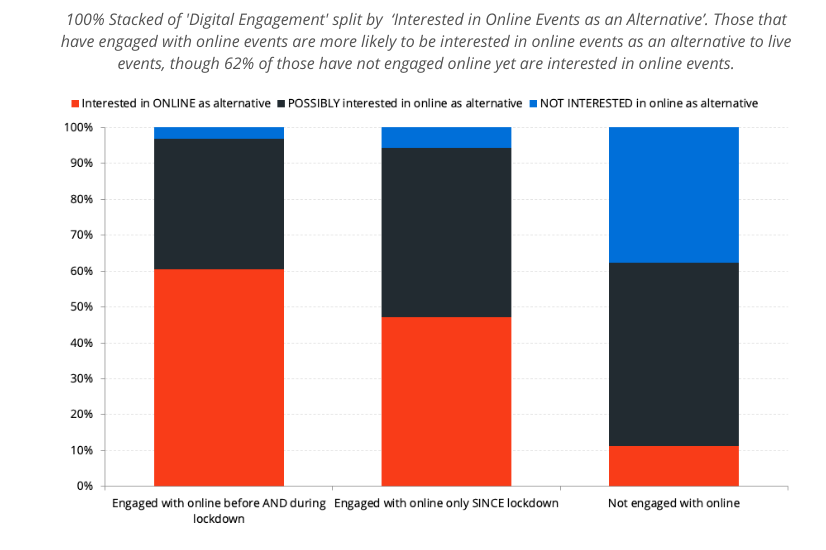

- There is a large segment of audiences who have not engaged yet online and would be interested in it as an alternative.

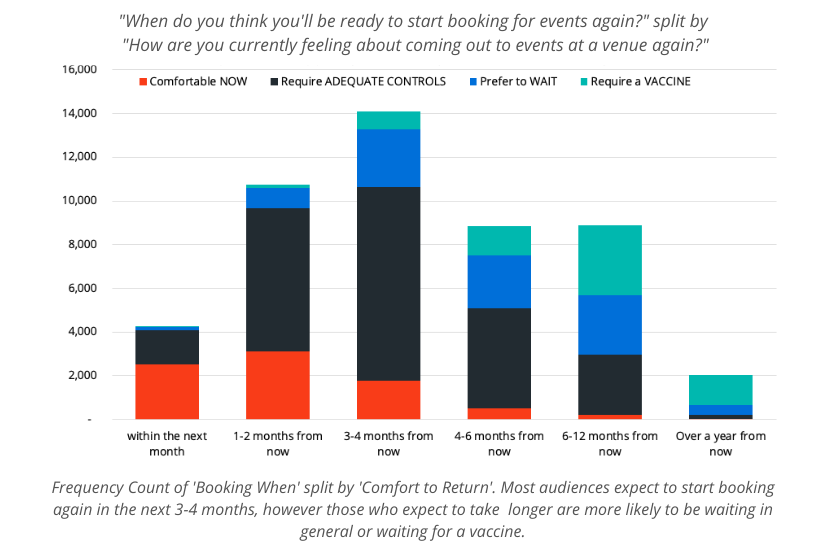

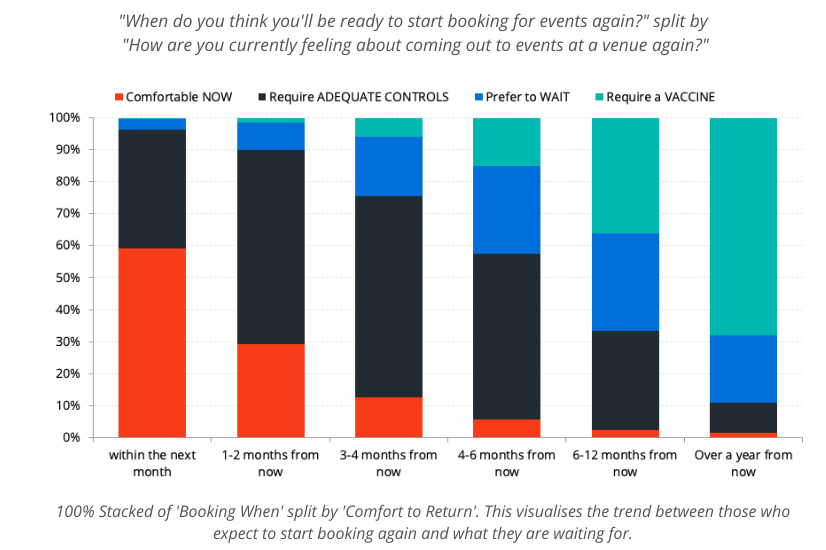

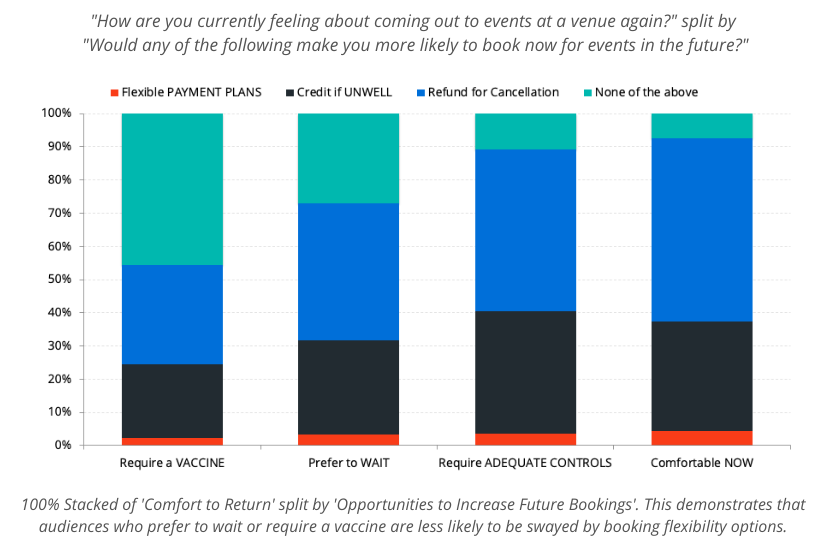

- Audience who will start booking sooner feel more comfortable about returning to venues. Audience who are do not expect to consider booking again for 6 months plus are more likely to be waiting for a vaccine.

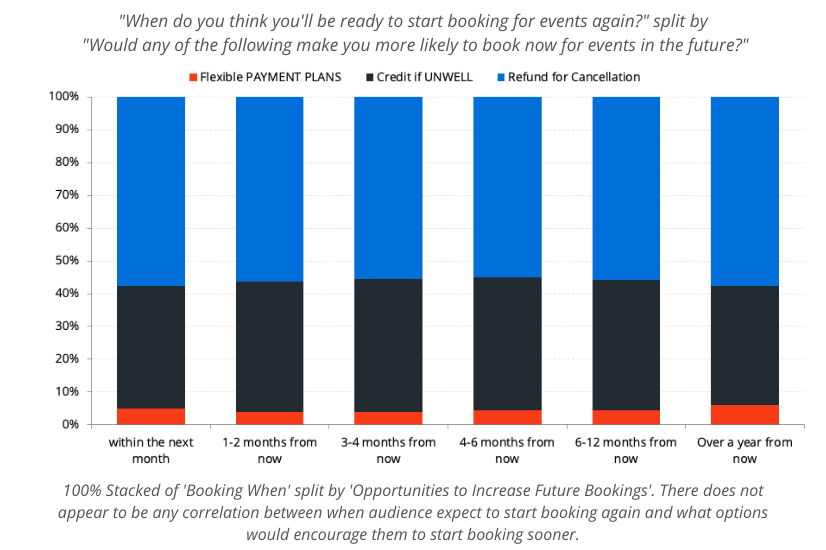

- There does not appear to be any connection between audiences that require adequate controls at events and when they expect to book again. Offering refunds, credits or flexible payment options has no effect on when someone expects to book again.

- Audiences expect to spend the same as before (approx 80%). Those who have had their income disrupted are slightly likely to spend less than before, and those without disruption are slightly likely to spend more.

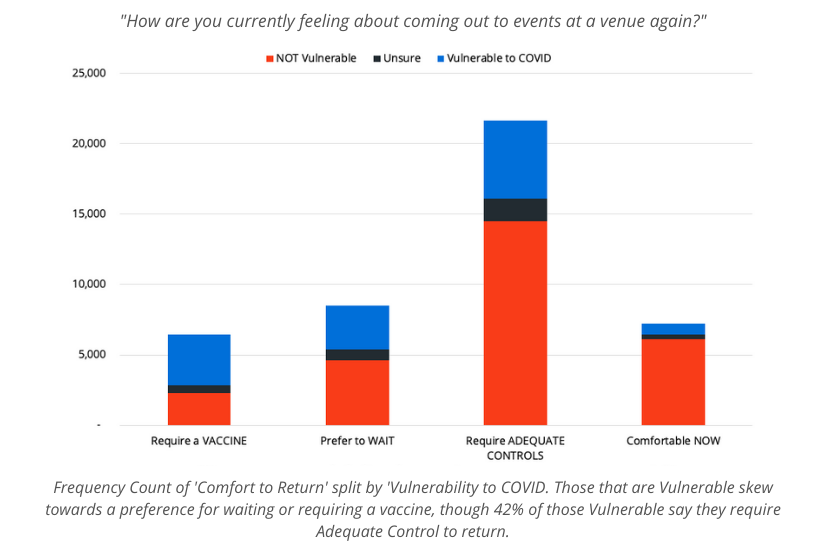

- Those that identify as ‘Vulnerable to COVID’ are more likely to stay away. Age, Region, Artform, Frequency of Attendance and Income Disruption do not meaningfully effect the likelihood of audiences returning. People with disability are more likely to identify as ‘vulnerable to COVID’, but the effect on likelihood to return is lessened. This will require further analysis.

More details of the analysis are provided in the methodology section.

Factor analysis

What factors have the strongest effect on how respondents answered?

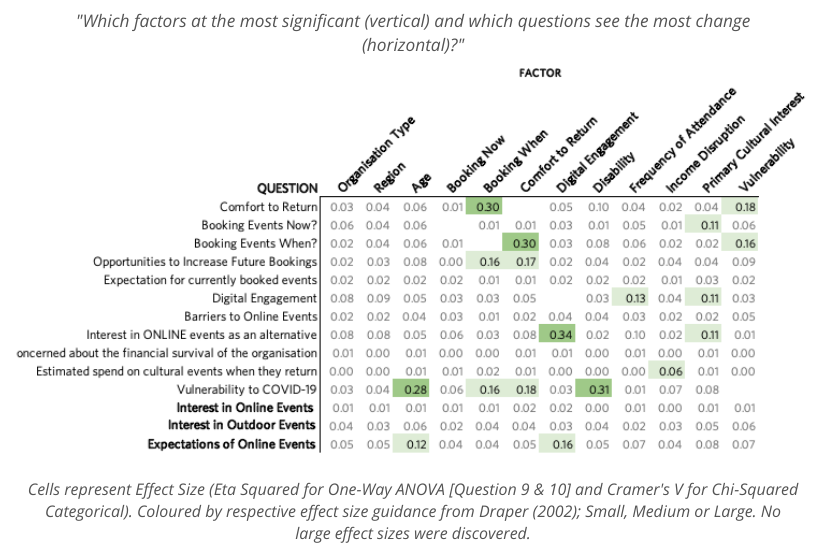

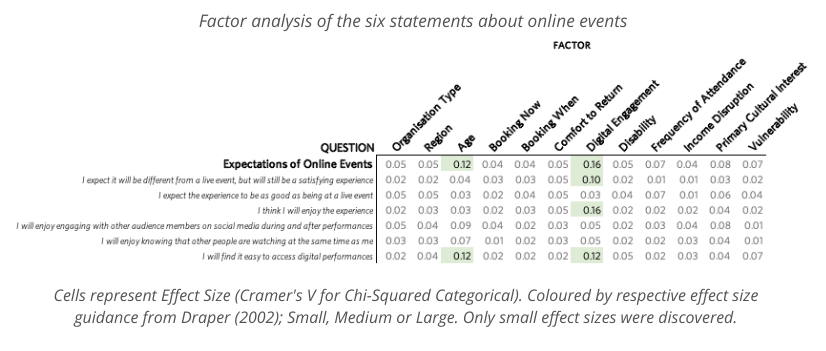

The following matrix maps the ‘effect size’ caused by every factor in the survey, compared to the question being asked. When there is an effect, we expect to see a difference in the result when split by that factor. The bigger the number, the more difference we see in the result.

There are very few factor effects; nine small factor (excluding online events) and only four medium-size factors. ‘Vulnerability to COVID-19’ is the most influential factor and was explored in the previous April analysis. This factor analysis pulled the main highlights and is presented in three broad sections:

- Returning to Events

- The Role of Digital Events

- The ‘Regular Attendee’

Returning to events

The survey was interested in finding out when the audience would return to live events, when they would start booking again and what they expected events to be like in the future.

- Age, Region, Artform, Frequency of Attendance and Income Disruption do not meaningfully effect the likelihood of returning. Those that identify as ‘Vulnerable to COVID’ are more likely to stay away. The effects of those with disability requires further analysis.

- Audiences that are either waiting for a vaccine or will prefer to wait are unlikely to be swayed. Most audiences expect to start booking again in the next four months and want adequate controls in place.

- Payment plans and other flexible booking options appear to have no effect on someone’s likelihood to start booking events again. Again, those that want to wait appear to be more likely wanting a vaccine.

Digital event

- Audience perceptions of online events do not appear to strongly differ. The biggest influence on someone’s perception is whether they’ve engaged with an online event before.

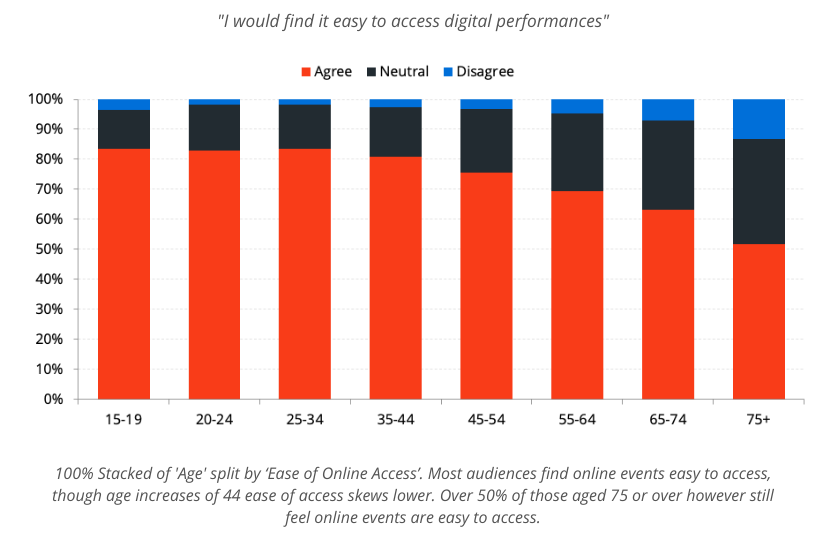

- People aged 44+ are less likely to believe digital performances are easy to access, though 50% of those aged 75+ still believe digital performances are easy to access.

- Audiences that have engaged with online events are more likely to be interested in attending them in the future, but even 62% of those who haven’t attended online before say they would consider it in the future.

- Attending online events does not influence your impression about online events as a replacement for live events. Most audiences do not expect online events to be good as live events, but those who attended them are much more likely to expect they will enjoy the experience.

Regular attendee

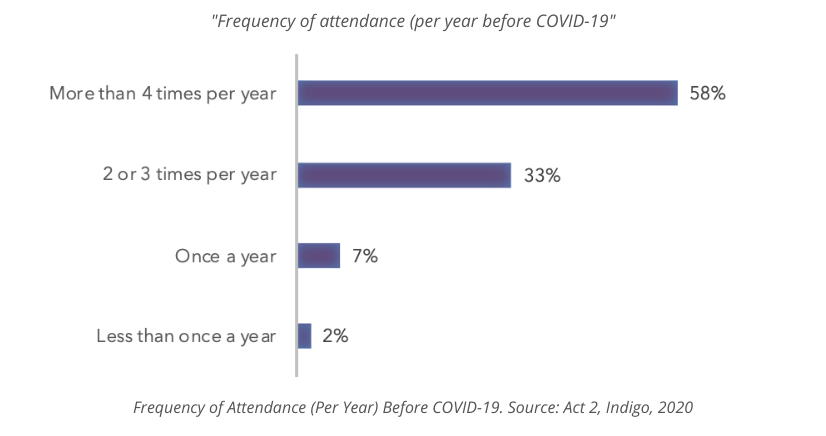

The survey collected the majority of responses from those that would be considered as frequent attendees. Generally this is not a problem when analysing survey results, as this factor analysis shows, however this attendance frequency is unlikely to match a random sample of an ‘average’ audience.

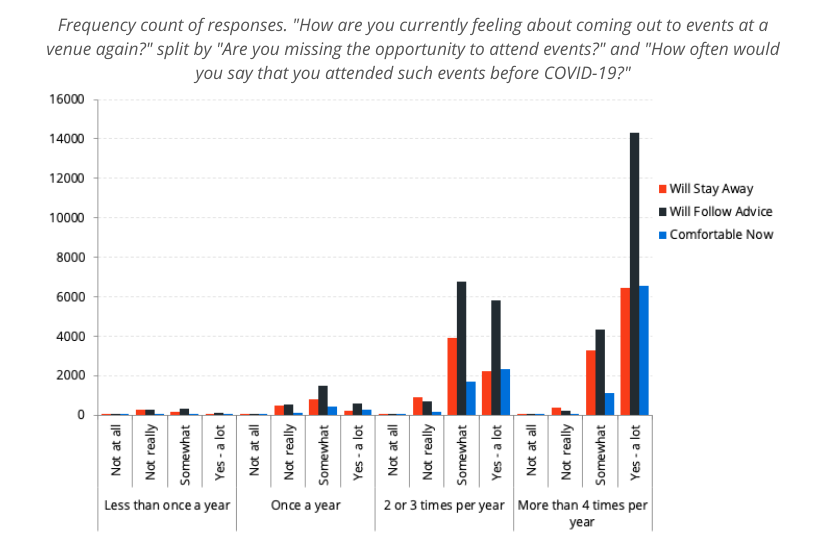

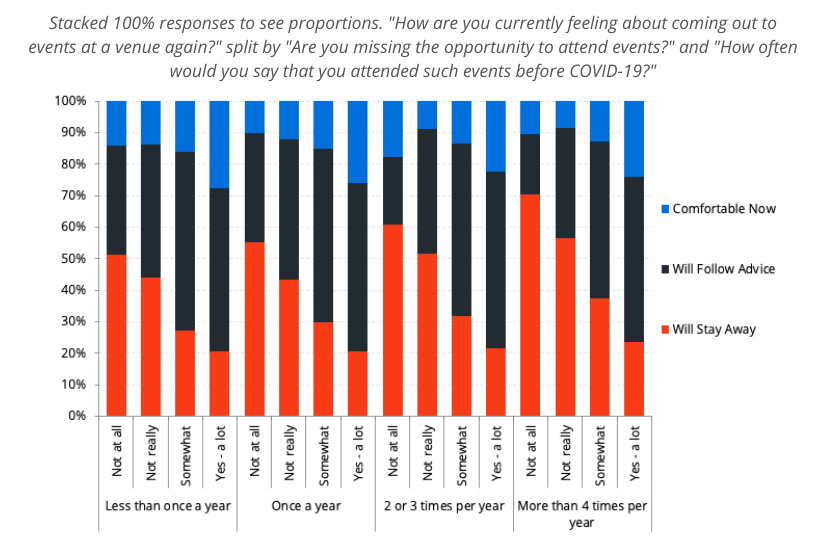

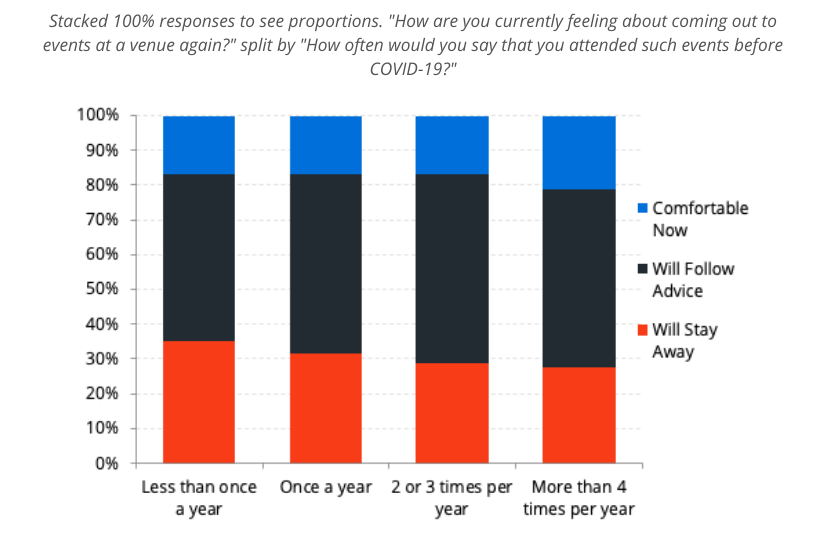

As found in our previous factor analysis, those that attended events more frequently were the ones that missed events the most. Those that missed events were more likely to return, so it could be assumed that this correlation would follow – that those who attended more frequently were more likely to return sooner. This is incorrect.

The interaction between ‘frequency of attendance’ and ‘likelihood to return’ is all due to how much someone misses events. Those who miss events AND only attend one per year are just as likely to return as those who miss events AND attend 4 events or more per year. There is a correlation between missing events and how frequently you attend, but it is that those that attend frequently AND do not miss events are less likely to return than those who attend infrequently. This only represents a small number of survey respondents and when aggregated the effect is neutralised.

This is a fascinating result and deserves significantly more study. The explanation of these results is visualised below.

Conclusion

The Act 2 survey offers cultural organisations a unique approach in collaborating to understand the complexity and diversity of our audiences and how they are responding at this moment. In combining our resources and sharing information, we are better able to understand what response we can make jointly as a sector and where it is important to differ, based on our respective communities of interest.

As more questions emerge, we will continue to revisit this analysis as we progress through this pandemic.

Appendix – Methodology

Using the Act 2 survey data provided by Indigo-Ltd, we designed an analysis framework to understand how certain factors influenced the results of the questions being asked.

The primary questions in the survey were

- Comfort to Return (Please tell us which of the following statements best fits how you’re currently feeling about coming out to events at a venue again?)

- Booking Events Now? (Are you actively booking NOW for events in the future?)

- Booking Events When? (If you had to say now when you think you’ll be ready to start BOOKING for events again, which of the options below would you choose?)

- Opportunities to Increase Future Bookings (Would any of the following make you more likely to book NOW for events in the future?)

- Expectation for currently booked events (What is your current expectation regarding this event?)

- Digital Engagement (Have you engaged with any cultural events ONLINE, either before or during the recent lockdown?)

- Barriers to Online Events (Which of the following reasons explains why you are NOT interested in engaging with cultural events online or digitally?)

- Interest in ONLINE events as an alternative (If you were unable to go to cultural events in a venue for the foreseeable future, would you be interested in engaging with cultural events ONLINE?)

- Concerned about the financial survival of the organisation (How concerned would you say you are about the financial survival of the organisation who sent you this survey?)

- Estimated spend on cultural events when they return (How much do you think you will be able to spend on cultural events once they can happen again ‘as normal’?)

- Vulnerability (Would you currently regard yourself as a ‘vulnerable’ person in relation to Coronavirus?)

- Interest in Online Events (Which of the following might you be interested in engaging with online in the future?)

- Expectations of Online Events (To what extent do you agree with the following statements regarding your expectations for online events?)

- Interest in Outdoor Events (If you felt confident that the appropriate social distancing measures were in place, which of the following types of outdoor events would you be most interested in attending?)

When considering these questions, we consider the following factors to see if they make any difference on the response

- Age

- Region

- Organisation Type

- Income Disruption (Has your income reduced or disappeared as a result of Coronavirus?)

- Vulnerable (Would you currently regard yourself as a ‘vulnerable’ person in relation to Coronavirus?)

- Disability (Do you identify as a D/deaf or disabled person, or have a long-term health condition?)

- Primary Interest (If you had to choose one type of performance as your PRINCIPAL interest, which of the following would it be?)

- Frequency of Attendance (How often would you say that you attended such events before Coronavirus?)

- Booking Now? (Are you actively booking NOW for events in the future?)

- Booking When? (If you had to say now when you think you’ll be ready to start BOOKING for events again, which of the options below would you choose?)

- Comfort to Return (Please tell us which of the following statements best fits how you’re currently feeling about coming out to events at a venue again?)

- Digital Engagement (Have you engaged with any cultural events ONLINE, either before or during the recent lockdown?)

We generally find in our audience research that everyone’s audience is slightly different. When we consider our main questions and the factors that can alter the results we can see where we need to have a diversified response to help our audiences engage with us again.

Indigo-Ltd conducted the Act 2 survey with cultural organisations in the UK. More information is available here and the initial results are available here. This analysis was conducted by Culture Counts in partnership with Indigo-Ltd.

Culture Counts provides online evaluation solutions for measuring impact.